Online networks such Airbnb and Vrbo have made that one popular. Treliant provides customized answers to seamlessly include the new proposed laws on the affected functions’ operating techniques. With total training, sleek reporting buildings, and continuing help, Treliant might help companies, and attorneys, effortlessly use the newest revealing requirements and reduce interruptions in order to “organization as always” techniques. A choice Several months is actually amount of time determined by the newest bargain, often five to 14 days, when the customer can also be check the home and find out if or not he/she desires to continue with the purchase of the house. A tiny percentage, the possibility Commission, is actually repaid as the thought for it several months.

Find your loan terminology, rates, and more!: wolf run real money $1 deposit

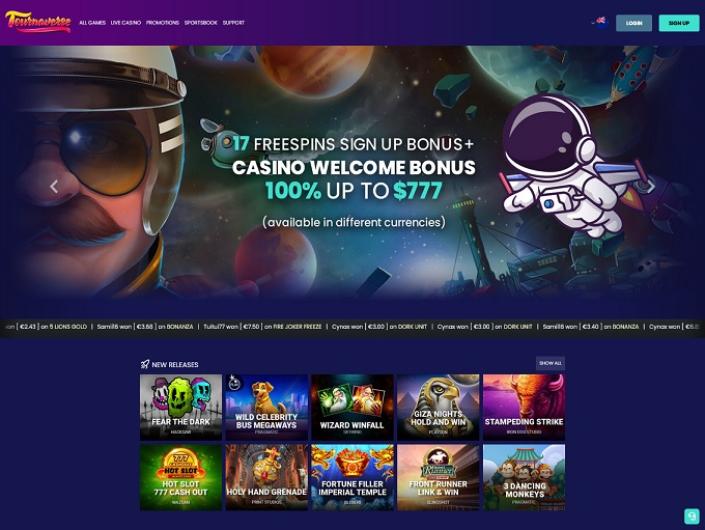

Baccarat is an additional belongings-based casino staple who has and adult preferred on line. People delight in its convenience and you can advanced possibility, having Banker bets going back almost 99%. Because of its ease and you can seemingly a great chance, roulette is becoming one of the most well-known on the internet online casino games. Online casino slots are offered by those higher-reputation online game manufacturers, along with NetEnt, IGT, Konami, Everi, Large 5, Konami, Aristocrat, White hat Gaming, and you will Settle down. Harbors take over internet casino libraries, spanning regarding the 90% of the portfolio.

Are a house REITs a no-brainer?

The phrase “residential tough currency” whenever known in the a property financing, is basically a non-bankable mortgage on the a financial investment unmarried house (or duplex). The name domestic tough cash is apparently interchanged with “no-doc”, individual finance, bridge fund, etc… To own a domestic tough currency loan, the newest underwriting behavior are derived from the newest borrower’s difficult property. In cases like this the newest domestic funding a home would be utilized because the security (through an initial financial) to your transaction. Residential Difficult currency closes rapidly (in the less than 3 or 4 months depending on the circumstances). Investors is be eligible for investment no matter what its credit scores or nationality. Extremely advantage-dependent individual money lenders financing doesn’t work on private obligations or credit rating when making a lending decision.

How to Purchase A home: 5 Easy Tips for Novices

FinCEN expects your duty so you wolf run real money $1 deposit can document A house Records create fundamentally apply to settlement agents, name insurance coverage representatives, escrow representatives, and you can attorney. The new NPRM, yet not, designates only one reporting person the provided reportable transfer, which is felt like in one of two means, the new Reporting Cascade or from the created arrangement. You could also become a difficult loan provider, however’ll require some money. It likely isn’t likely to be the initial way you start out making money in home, however, since you build your network, financing, and you may a powerful portfolio out of sales, you might offer these types of connection finance making a rates of come back.

REITs

Once recognized, North Shore Monetary can also be fund the mortgage inside the as low as 3-five days to possess money spent. Owner occupied fund generally take 2.5 months because of the most recent federal regulations that loan providers have to adhere to. The new declaration have to be submitted by later on day of either (1) the past day of the fresh month following week where the newest reportable transfer occurs; or (2) 30 diary weeks following the time of closure.

By simply making a part hustle (or full-time profession) out of home-based a property, you possibly can make an established source of income. Whether or not a property opportunities are quicker water and will be much more time-sipping than simply organizing your own offers on the stock-exchange, the chance of steady couch potato earnings and you may a varied money collection can cause a desirable lead for your buyer. During the GreenBridge Financing, we understand exclusive pressures and you may possibilities against domestic home investors now.

Commercial Spending: Output and you may Risks

Yet not, expect highest upfront can cost you, and off costs away from 20-30% or even more, and you will be the cause of the increased rates of interest. Despite these types of will cost you, self-reliance inside financing structuring and you may fast approvals create tough money money an important unit for family flippers focusing on quick investment completions. On the RealPageLocated inside the Carrollton, Colorado, a suburb from Dallas, RealPage brings for the request (also known as “Software-as-a-Service” otherwise “SaaS”) services and products in order to apartment groups and you will unmarried family members apartments around the the usa.

Obviously, this means opting for straight down-priced belongings or disturb features and you will flipping contracts. It also function looking difficult-currency lenders or any other buyers that can help you push product sales due to. This might even connect with family renovations providing you’re also good at locating the money. All-dollars purchases out of home-based home are considered at the high risk for the money laundering. All of our members of the family at the Chicago Term Insurance agency provides mutual details about a new rule applicable so you can low-financed domestic a house transfers the spot where the consumer try a keen entity or faith.

In the event the, including, the property industry climbs dramatically, you can buy you to definitely property at a discount. You can also turn around and sell their legal rights for that purchase to other people. So long as this can be an option you could potentially get it done and you may not at all something set in brick you to states you have got to buy after the new book regardless of, then you could really well make a profit.

To add independence and reduce conformity burdens, the past Rule includes a great “cascade” program to determine first submitting duty and you may lets industry advantages in order to designate conformity obligations one of on their own. Financial institutions or any other institutional lenders typically have rigorous lending requirements and therefore results in of many borrowers with the applications declined. Earnings background and you may credit are often area of the criteria financial institutions work with. Items such as bad credit, and you will previous foreclosure, bankruptcies, mortgage changes or quick conversion process might be warning flags to help you a good lender. Draw equity in one assets so you can purchase some other possessions is a common strategy for of many home traders. Lead tough money fund enable it to be people to complete cash-out refinances in no time, making it possible for the new investor in order to capitalize on another home chance.

Depending on the loan, interest rates begin only 7% by creating. The shape often ask you to define whether you’re seeking to a buy or refinance loan, your local area in your techniques, the region of the home as well as the loan system of great interest. For the reason that homebuilders’ will set you back go up which have inflation, and that must be died so you can buyers of new property.