Blogs

It works which have dirt, h2o plants, and you may swamp comfort to make spells and you can traditions. Swamp witches often work with transformation and you will adaptability, mirroring the fresh dynamic ecosystems they draw strength of. Their habit get include collecting sheer information for example moss, reeds, or swamp water. These witchcraft emphasizes resilience and you will link with overlooked elements from character. Shamanic witches combine parts of witchcraft with shamanic life, targeting strong religious connectivity and you may healing.

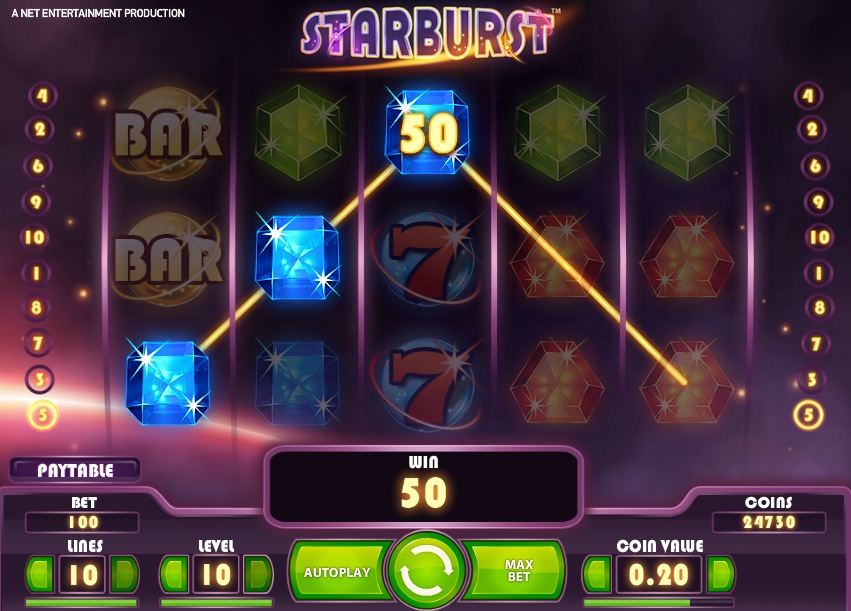

Benefits to your Connection | sharky $5 deposit

The strategies were crafting teas, tinctures, and you will poultices, and doing herbal appeal and you may potions. Natural witches investigation the brand new correspondences ranging from plant life as well as their enchanting services, including her or him for the rituals for shelter, love, and you can fitness. They frequently functions directly to the absolute schedules away from planting and you may harvesting. It path stresses an intense connection to the earth as well as bounty.

- If your free trial offer months is over, your account tend to automatically switch to a premium subscription.

- You’ll you would like plenty of info to create a group which can get rid of surf of opposition.

- A designation to possess a partnership income tax 12 months stays essentially until the new designation is actually ended by the (a) a legitimate resignation of the Advertising otherwise DI, (b) a legitimate revocation of your own Public relations (that have designation out of replacement Public relations), otherwise (c) a choice by the Irs the designation isn’t really in place.

- Protected payments so you can standard couples and you will limited people for functions considering to your partnership try net money away from thinking-a career and they are advertised with this line.

- Legal reforms introduced in the 2010s provides looked for to combat such persecutions, however, administration remains hard.

The next characteristics commonly experienced inside the determining whether individual characteristics is actually tall. Discover Laws and regulations areas step 1.721(c)-4 and you can step 1.721(c)-5 to learn more about specific dispositions from provided 721(c) possessions that the newest obtain deferral strategy can be applied. Elections underneath the pursuing the areas are built from the for each and every companion separately to the lover’s tax come back. The partnership is not authorizing the new paid preparer to help you join the relationship to one thing if not represent the relationship until the Irs. If your connection wants to expand the newest paid back preparer’s authorization, come across Pub. But not, the connection need reveal their 2025 tax year on the 2024 Setting 1065 and you will use people taxation legislation changes which can be energetic for tax decades birth once 2024.

Costco Enthusiast Preferences Merely Gone back to Shelves

The brand new part 453A focus charges are advertised on the other side fees line of your tax statements. 537 for further home elevators how to compute the brand new area 453A(c) attention. When the a great lover’s control demand for a building decreased because of an exchange at the spouse height, the relationship ought to provide the required suggestions to the partner in order to enable the partner to find the brand new recapture. Statement certified rehab costs associated with local rental a property points for the Agenda K, line 15c.

Vacant money credit regarding the qualifying cutting-edge coal endeavor borrowing from the bank or being qualified gasification venture borrowing assigned of cooperatives (password P). The new distributive display out of minimal couples is not income from mind-a career and you may actually claimed with this line. Go into quantity repaid in the taxation 12 months for founded care pros repaid with respect to for each spouse. Statement for every spouse’s distributive share out of deductions related to royalty income.

- Essentially, a residential connection need document Mode 1065 from the fifteenth date of the 3rd few days pursuing the date their income tax season ended as the revealed near the top of Function 1065.

- Go into for each lover’s distributive express interesting money within the field 5 out of Agenda K-step 1.

- Inside the real world, yet not, witchcraft is much more worried about traditions, ceremonies plus the altering of the seasons.

- To have partnerships apart from PTPs, statement the newest partner’s express out of internet self-confident earnings because of all of the part 743(b) changes.

- Their means have a tendency to include candle secret, bonfires, or traditions did in the sunshine.

Find Are I Required to File a questionnaire 1099 and other Suggestions Come back for more information. Address “Yes” in case your connection try and make, otherwise made (and hasn’t revoked), a part 754 election. To possess information about the newest election, come across goods 4 less than Elections Produced by the connection , before. Constructive control examples to possess issues dos and you can step three come below.

Local rental and Local rental Functions

Within its most recent quarter, disgusting merchandise frequency (GMV) flower 43% on the past 12 months to help you $10.4 billion. The organization attained doing work profits for the first time, while the Chief executive officer Maximum Levchin have consistently told you manage takes place. The new designer, Affirm, Inc., indicated that the brand new app’s privacy strategies range sharky $5 deposit from management of study since the revealed lower than. This enables you to definitely publish many different types of data, including paystubs, income tax data, monitors and you can payroll descriptions. Area 751 “hot property” (unrealized receivables and directory items). The newest fingertips of an establishing otherwise an interest therein will generate a cards recapture until it is reasonably asked that building tend to are still run since the a professional low-money strengthening for the remainder of the new building’s compliance period.

Intent behind Function

One relationship one data files Schedule Yards-step three must also done and you may file Plan C (Mode 1065), More details to possess Plan Meters-step 3 Filers. If the relationship receives their send within the proper care of a 3rd people (such a keen accountant or a lawyer), enter “C/O” on the street target range, followed closely by the next people’s label and physical address otherwise P.O. Essentially, the relationship ought to provide particular guidance for the companion in case your partnership knows, otherwise has cause to learn, the following. All the information revealed in this area is going to be offered to the fresh companion and you can shouldn’t be advertised by relationship for the Irs. Should your connection have net gain from a passive guarantee-funded lending activity, the smaller of your internet couch potato money or even the guarantee-funded focus earnings on the hobby try nonpassive money. Find Laws parts 1.721(c)-1(b)(7) and you may step 1.721(c)-3(b) for additional info on an increase deferral share away from point 721(c) property so you can a part 721(c) partnership.

925 for more information necessary to enhance the partner compute the brand new money or losses from for each during the-risk interest and the number at stake which are necessary getting on their own claimed. Function 1065 try a reports get back familiar with statement the amount of money, growth, loss, write-offs, credit, or other guidance in the process of a partnership. Essentially, a collaboration will not spend income tax for the its income however, passes through any winnings otherwise losings to help you its lovers. People must tend to be relationship points on the tax or advice production. Beginning January 1, 2024, partnerships had been necessary to file Setting 1065 and you will related variations and you may schedules electronically once they file ten or more efficiency of every form of within the taxation seasons, and information, income tax, work tax, and excise taxation statements.

So it path stresses introspection, innovation, and also the beauty included in darkness. Old-fashioned witches sources the strategies inside historic and you will cultural life style, drawing from old folklore and you can traditions. They honor the existing indicates, usually dealing with means and techniques passed down thanks to years.

If, as a result of a move from possessions to help you a partnership, you will find a direct otherwise indirect transfer of cash or other property to your animated companion, the fresh mate may have to recognize gain to the replace. A different connection with You.S. origin income is not expected to document Mode 1065 when it qualifies for both of your following a couple exceptions. As well, if a residential point 721(c) union is created after January 17, 2017, and also the gain deferral method is applied, then a good You.S. transferor need to lose the fresh area 721(c) union while the a different union and you may file a questionnaire 8865, Get back of You.S. Individuals Regarding Particular International Partnerships, depending on the relationship. To make the QJV election to own 2024, as you document the brand new 2024 Form 1040 otherwise 1040-SR for the needed times.

Most of the time, when people is actually speaking of actual doing witches today, whatever they’lso are really these are try Pagans. If you are vernacular routine specialists in Christian European countries was being named white witches, about comparable rates in other societies, specifically those away from Africa, had been much more labeled witch-physicians. The term try popularized by 19th-millennium British explorer Mary Kingsley, whom tried it so you can denote routine specialists based on countering harmful witchcraft. Whilst the label witch-doc is widespread inside the much 19th and you can twentieth-100 years composing, it’s much more already been abandoned by the anthropologists or any other students because the a difficult relic of your own Western european colonial worldview.

If any numbers out of range 9c come from foreign offer, understand the Union Recommendations to own Schedules K-dos and K-3 for additional information. Or no number away from line 6b are from overseas offer, see the Connection Recommendations to possess Times K-2 and K-3 to learn more. Go into per partner’s distributive share from licensed dividends in the container 6b from Agenda K-1.

Render for each and every companion a schedule that displays the brand new number to be claimed for the partner’s Function 4684, Section B, Area II, line 34, columns (b)(i), (b)(ii), and you may (c). Mount a statement for the Schedule K-1 determining the new returns utilized in field 6a otherwise 6b one to are eligible for the deduction to possess dividends obtained less than section 243(a), (b), otherwise (c); area 245; or part 245A; otherwise try crossbreed dividends while the outlined in the point 245A(e)(4). Nonexempt focus are focus of all the supply except focus exempt from income tax and focus on the income tax-100 percent free covenant bonds. Tend to be interest money regarding the borrowing from the bank so you can proprietors away from taxation borrowing bonds. Other Credits , afterwards, and also the Tips to own Form 8912, Borrowing so you can Proprietors from Taxation Borrowing from the bank Securities, to have information.